据联合早报讯:新加坡陆交局宣布政府将分三年付款,以约2880万新元(加上消费税为约3080新万元)的净账面价值购买地铁东北线和盛港榜鹅轻轨线的列车和信号系统等资产。陆交局指出,资产的转交不会对新捷运的运作与员工造成影响。

经七年协商,陆路交通管理局与公交业者新捷运完成了新地铁融资框架的谈判。政府将以约3000万新元向新捷运购买地铁东北线和盛港榜鹅轻轨线的列车和信号系统等资产,让业者更专注于经营地铁服务和维修。

陆交局昨晚发文告宣布,政府将分三年付款,以约2880万元(加上消费税为约3080万元)的净账面价值购买上述资产,新捷运将在今年4月1日正式在新地铁融资框架(简称NRFF)下经营东北线和盛港榜鹅轻轨线。

陆交局指出,资产的转交不会对新捷运的运作与员工造成影响。

NRFF于2010年推出,新捷运在2011年夺标经营的滨海市区线是首个在新框架下营运的地铁线。

随着东北线和盛港榜鹅轻轨线过渡到新框架,本地所有地铁和轻轨线都会在NRFF下营运。

政府已在2016年7月,以约10亿元向SMRT购买了地铁南北线、东西线、环线以及武吉班让轻轨线的资产。

根据新框架,业者每年得向当局支付一笔执照费,这笔费用将注入由陆交局监管的地铁累积基金(Railway Sinking Fund),用于抵消政府在建造、更换和提升设备的花费。

政府也会根据税前盈利率(Earnings before Interest and Taxes,简称EBIT)与业者共同承担收入风险。

此外,配合新框架的推行,当局在2016年落实了一套“维修表现标准”,以提升业者的维修服务水平。若业者在维修方面达不到当局的要求,就得被罚款。东北线和盛港榜鹅轻轨线过渡到NRFF后将实施这套标准。

不过,新捷运开始经营市区线时,NRFF仍未包括“维修表现标准”,但据了解,当局在检讨或修订NRFF时,或可将新标准的部分元素纳入市区线的NRFF中。

另外,在NRFF下,业者的地铁经营权从之前的30年至40年缩短至15年,若表现良好,经营权可多延五年。新捷运东北线和盛港榜鹅轻轨线在NRFF下的经营权将在2033年到期,市区线经营权则从去年全线通车后算起,到2032年期满。

陆交局在解释NRFF的好处时指出,新框架能让政府更适时地掌控地铁资产的采购与更新,进而提升服务可靠度。业者也因无需管理资产,能更专注于营运与维修,而经营权期限的缩短能让当局更早进行招标,使市场更具竞争性。

新捷运昨晚发文告指NRFF是“更可持续且轻资产”的运作模式。文告引述新捷运总裁颜睿杰说:“新框架从长期来看是更可持续的营运模式,我们能因此更专注于运作和维修地铁系统,进一步提升服务素质。”

东北线过渡到新框架

可避免南北和东西线问题

新跃社科大学经济系高级讲师特斯拉博士(Walter Theseira)受访时指出,新捷运在NRFF下经营东北线,或能避免南北和东西线因系统老旧而频频面对故障的状况。“在先前经营模式下,业者可能会因盈利考量而缩减维修及更新地铁资产的成本,否则可能面对亏损。NRFF能减轻业者负担,政府也能更好地确保地铁资产的运作状态,而东北线还不算太旧,如今过渡到新框架下相当适时,或可避免南北和东西线近年来所面对的故障问题。”

NRA资本研究部主管刘锦树也认为政府收购地铁资产对新捷运有好处,能助降低营运成本,因为新捷运无需承担资产折损。他受访时指出,这也会让新捷运的资产负债表更轻,一般上有利提高股本回报率(ROE)。“不过,这项地铁资产收购实际对股本回报率的影响,还得看营业成本的改变和收费调整等因素。”

陆交局公告(英文):

The Land Transport Authority (LTA) and SBS Transit Ltd (SBST Ltd) have concluded discussions on the transition of North East Line (NEL), Sengkang LRT and Punggol LRT (SPLRT) to the New Rail Financing Framework (NRFF). This completes the transition of the entire rail network to NRFF. With LTA owning all rail operating assets, commuters will benefit through more coordinated and timely expansion and renewal of the rail system.

2. NEL and SPLRT will transit to the NRFF on 1 April 2018, and SBST Ltd will be granted a 15-year licence to operate the lines until 31 March 2033. SBST Ltd will transfer the operating assets under the NEL and SPLRT to LTA at Net Book Value[1] as at 31 March 2018. Thereafter, LTA will own the operating assets for these lines. In return for the right to operate these rail lines, SBST Ltd will pay LTA a Licence Charge to be set aside in the Railway Sinking Fund (RSF) for the renewal of operating assets. The Licence Charge structure is identical to that for SMRT Trains.

3. The transition will benefit commuters by:

a) enabling the Government to ensure timely procurement of additional trains and operating assets to enhance reliability and keep pace with growing ridership demand,

b) relieving rail operators from heavy capital expenditure and large fare revenue risks so that they can focus on their core role of operating and maintaining the rail network, and

c) making the industry more contestable by shortening the licence period from 30 – 40 years under the previous financing framework to 15 years, with a possible 5-year extension.

4. As part of the transition, LTA will conduct an asset condition survey of the operating assets and make payment for the assets in tranches over the next two years: 60% of the payment will be made on the date of transition, and the remaining 40% will be paid in two instalments of 20% each on the next two anniversaries of the transition.

5. SBST Ltd will provide warranties on the condition of the assets over this two-year period, and LTA is entitled to withhold payments for assets requiring rectification or replacement. The transfer of ownership of operating assets will not affect day-to-day rail operations and SBST Ltd’s employees.

6. Under the licence issued to SBST Ltd, LTA will continue to emphasise enhanced maintenance standards for improved rail reliability through the Maintenance Performance Standards (MPS), a set of requirements, delivery standards and process controls first introduced as part of SMRT Trains’ transition to the NRFF in 2016. The MPS takes a prescriptive approach of regulating SBST Ltd’s maintenance processes upstream by stipulating process-based maintenance requirements so that issues can be identified and addressed early.

About New Rail Financing Framework

7. Under the previous financing framework, rail operators own the operating assets, such as trains and the signalling system, and are responsible for building up, replacing and upgrading these assets. However, as the operators bear the full financial risk, they may be too cautious to undertake costly capacity expansion, replacement and upgrading works. They may also be less responsive to growing ridership and commuter expectations.

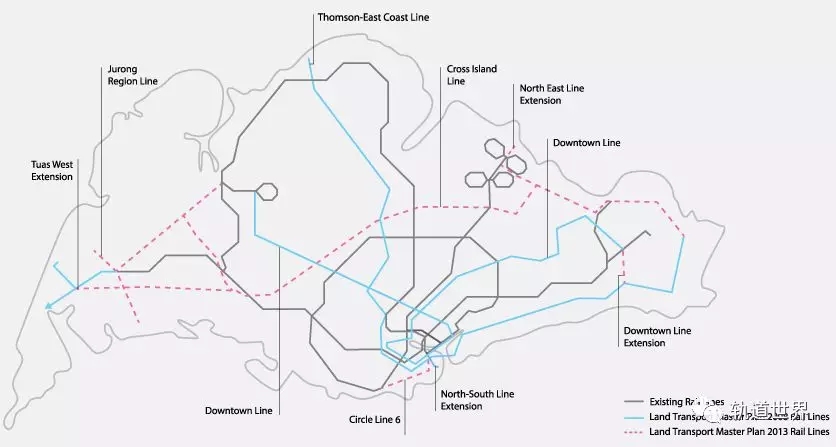

8. The Government announced the NRFF in the 2008 Land Transport Master Plan. In 2010, the Rapid Transit Systems Act was amended to implement the NRFF. The NRFF was first implemented in 2011 for the Downtown Line operated by SBST Ltd, and subsequently extended to the North-South and East-West Lines, Circle Line and Bukit Panjang LRT, which are operated by SMRT Trains Limited, in 2016.

9. The NRFF provides for profit and risk sharing between the operator and LTA. LTA will share some of the shortfall in fare revenue and profits when fare revenue growth fails to keep pace with cost growth. If profits outperform, operators will pay an increased Licence Charge into the RSF. In addition, LTA may reimburse the operator, or vice-versa, if there are changes to the operator’s operating cost or revenue as a result of new regulatory changes initiated by LTA.

10. The NRFF is an integral part of the Government’s effort to enhance the quality, reliability and sustainability of our rail system. With all our existing rail lines now on the NRFF, the Government will be able to plan network capacity holistically and improve rail capacity for Singaporeans in a timely manner. Commuters will also benefit from higher-quality rides and a system that is more responsive to their needs.

[1] The Net Book Value of assets refers to the value of the assets as indicated in a company’s financial statements. It is equal to the original cost of the assets minus any accumulated depreciation. In this case, it refers to the value of operating assets on SBS Transit’s financial statements as at 31 March 2018, which amounts to S$28.8 million (S$30.8 million including GST).

素材来源:联合早报 LTA等 顶图by搜索引擎推荐

转自:轨道世界